Justin Levine

Co-Founder & CEO

December 19, 2022

What an amazing ride it’s been here in 2022. We’ll always remember this year as the beginning of Shepherd, moving from idea to launch, but more importantly as the first critical step in changing the way contractors think about their insurers.

Looking back, it’s easy to see a lot has changed. In the first months of 2022 we were still adding key members of our founding team, building version 1.0 of Shepherd’s policy admin platform, and finalizing the capacity relationships to support our Excess Casualty program. By the end of the year we’ve emerged as one of the most active Excess markets:

16 retail brokerage partners

300+ submissions; +23% growth quarter-over-quarter

Bound accounts ranging from $40k to $1M in GWP

Exposure in 35 states across the U.S.

We remain laser focused on the long term path of sustainability and profitability in favor of shortcuts to drive growth. There is a long history of MGA’s who enter the construction industry with intent to write high premiums in the most volatile areas. They don’t last. We’ve challenged ourselves to find different ways to differentiate and provide value, while competing for the best contractors and the most favorable projects.

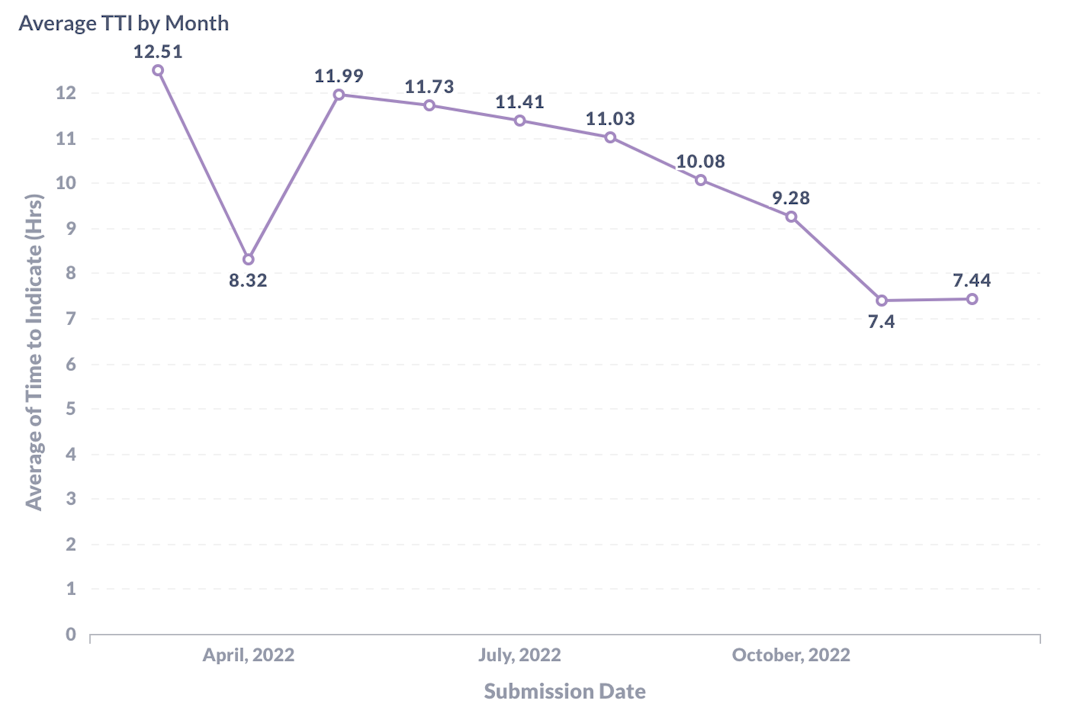

The first area we differentiate is our speed. When we launched Shepherd we promised to respond to every submission with an indication in 24 hours or less. Thanks to the efficiencies provided by our engineering team, not only have we far exceeded this goal, but our average response time continues to decrease month over month. The feedback from our broker partners has been nothing short of phenomenal in this regard. Responsiveness and speed yields more opportunities and often multiple looks at the same account before binding.

Average time to indication (TTI) by month

Average time to indication (TTI) by month

In May we launched Casualty Pro - a first of its kind insurance technology-integrated offering for middle market construction. The concept is to reward contractors who have already made critical investments in construction tech products that make them safer and help them deliver high quality products. Since launching this program, over 40% of our submissions come from contractors who leverage one of our Casualty Pro partners (a remarkable number when you consider just how enormous the construction industry is) and this has led to thousands of dollars in underwriting credits or improved coverage terms. In 2023, we plan to take Casualty Pro to the next step by creating incentive plans that tie construction tech usage into our renewal terms.

Today, Shepherd builds incredible internal tools that are rarely seen by our partners or customers, despite having a massive impact on customer experience. We’ve created, from scratch, a policy admin platform that handles everything from submission intake through pricing and document generation.

To eliminate any friction in working with us, we receive submissions “as is” (often via PDF and excel spreadsheets), and in 2022 we used our platform to reduce manual data entry by 40% per submission, with an ultimate goal of removing manual entry altogether. We automate many parts of the compliance process such as licensing verification, OFAC clearance, and account reserving.

Our long term technology advantage comes from the simple fact that everything occurs in one place - the same platform that we use to develop a personalized loss pick based on an insured’s claims history is also where we can create an invoice and track payments. This is fundamentally different from most insurance providers who often stitch together several unique systems in order to underwrite a single account. By aggregating all of these functions into one platform, we’re able to visualize and study our dataset on a real time basis. Much of the data learnings from adding the first 300 submissions to our product have shaped strategy for the rest of the company in areas like customer success or distribution.

In 2023 we’ll be putting our platform to the test, using what’s already been built as the foundation for expansion into additional product lines. The success and learnings from our entry into primary casualty lines becomes the template for us to efficiently build out our industry practice offering year over year. We’ll also be introducing our first customer facing tools - something we’re particularly excited about going forward!

Since we conceptualized Shepherd the goal has always been to be a primary lines insurer. We started with Excess Liability for two reasons: 1) speed to market - the ability to launch quickly on a countrywise basis, and 2) the overwhelming market demand, especially for contractors needing capacity within the first $25M of casualty risk. I think we can say definitely this was the right decision. And while this strategy has worked extremely well for us, we know that the larger industry impact that we seek comes from being a Primary lines insurer.

In 2023 we’ll be launching with a 3-line primary solution, providing CGL, Commercial Auto, and Workers’ Compensation coverage for the same middle market contractors and projects that we already engage with today. Much of the setup work to support this expansion took place over the second half of 2022, both from a product and underwriting perspective. We’re building upon the foundation of what already exists from a technical standpoint, avoiding rework and creating a consistent experience for both our own underwriting team as well as our customers. We’ll still be industry best in terms of speed, and we’ll extend our data advantage further.

Much of the noise coming from Shepherd in 2023 will be the countrywide rollout of these new products, paired alongside our existing Excess program – positioning us to make a leap forward in terms of industry impact and innovation.

As 2022 comes to a close, we’re filled with gratitude for so many things. We’re particularly grateful for our brokerage partners – without their support and willingness to bring in Shepherd as a new market to their clients we would be nothing. We also want to recognize the unique commitment of our technology relationships: Procore, Autodesk, and OpenSpace who have each built incredible products that make our customers safer, more productive, and more efficient. With their support, we’ve been able to improve on the way contractors are traditionally underwritten in this industry.

Looking ahead, we know we’ve only begun to chip away at the iceberg of potential to innovate in this market. We can’t wait to tell the world more specifics about our plans and products for next year. Stay tuned for big updates as we begin to go live on a state by state basis with primary lines in 2023.

Happy holidays from team Shepherd!

Read more from Shepherd

Introducing Shepherd AI Compliance: Advancing Construction’s Insurance Technology

The first offering of Shepherd's free software platform for insureds

Justin Levine

Co-Founder & CEO

February 27, 2024

Announcing Shepherd's $13.5M Series A

Today we’re thrilled to announce Shepherd has raised a Series A financing, led by Costanoa Ventures

Justin Levine

Co-Founder & CEO

February 7, 2024

Any appointed broker can send submissions directly to our underwriting team